Instant Loan Baroda Personal Loan Details The interest rate on Bank of Baroda personal loan ranges from 10.00% to 15.60%. The minimum EMI per lakh is ₹ 2,125, as calculated on the lowest rate and longest loan tenure. Personal loans by Bank of Baroda are available for salaried working with government, private sector. Multinational companies and self-employed professionals such as doctors in the age group of 21 to 60 years.

The loan amount can range from ₹ 50,000 to ₹ 5 lakh. Bank of Baroda personal loan can be availed for a tenure of 12 months and can go up to 60 months. The processing fee charged by Bank of Baroda on personal loans is 2%, subject to a minimum of Rs. 250. Bank of Baroda allows personal loan foreclosure and part pre-payment with zero charges after 1 month.

Loans – Apply for Instant Loan, Bank of Baroda

Digi Hub is one of the innovative solutions that Bank of Baroda is pioneering to serve its Radiance customers outside large cities where bank has relatively leaner presence of specialized investment teams.

Flexible and easy-to-operate option for all. As the simplest form of deposit available to customers, this savings accounts is among the most popular type of bank deposits.

The product is in the nature of a superior Savings Bank Account with added value propositions to high value residential customers. The product is available at Metro and Urban centers. Accounts can be opened in single name as well as in joint names (maximum two). And both the account holders can also be covered under insurance subject to submission. Of requisite papers and payment of premium in respect of both the account holders.

An account for minors, 0-18 years of age. Theme-based RuPay Baroda Champ Debit Card issuance available to applicant individually above 10 years of age.

Bank of Baroda offers a wide range of loans to meet your diverse needs. Whether the need is for a house, child’s education, our unique and need specific loans will enable you to convert your dreams to realities.

- Loan Amount

- Rate of Interest(%)

- Loan Terms

- Equated Monthly Installment (EMI) will be

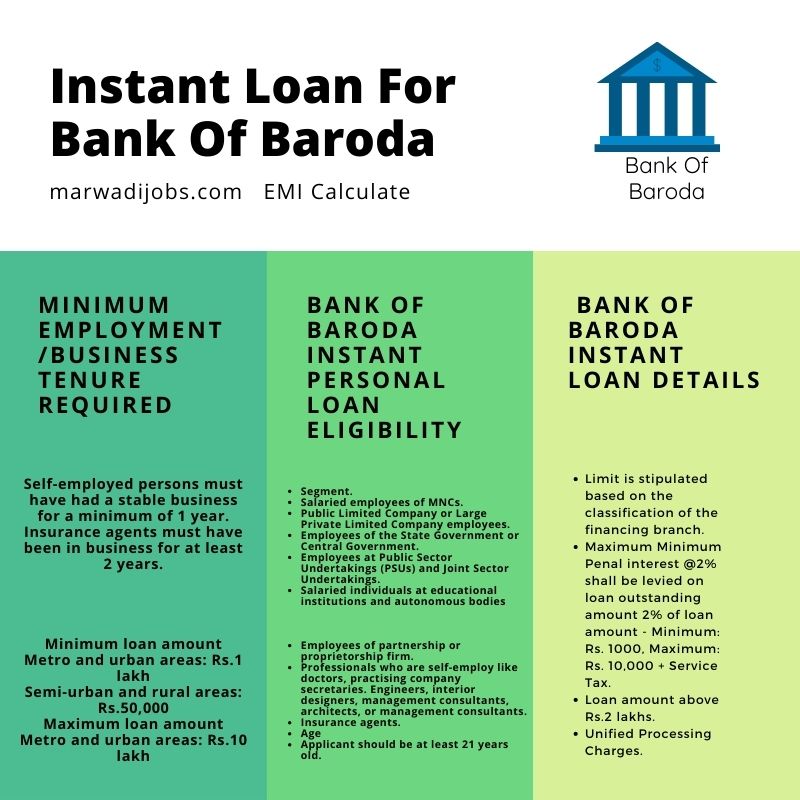

Bank Of Baroda Instant Loan Details

Personal loans from Bank of Baroda offer a quick and easy solution to all your urgent financial needs and have many advantages over other forms of credit. Such as credit cards and informal loans from friends, family members or untrustworthy financiers.

Applications to be considered on individual basis only. Co-applicants not to be allowed.

- Limit is stipulated based on the classification of the financing branch.

- Maximum Minimum Penal interest @2% shall be levied on loan outstanding amount 2% of loan amount – Minimum: Rs. 1000, Maximum: Rs. 10,000 + Service Tax.

- Loan amount above Rs.2 lakhs.

- Unified Processing Charges.

You don’t need to provide collateral if you are a personal loan borrower. This type of loan is intended to fund any financial contingency you may come across-business capital expansion. Marriage, education or even foreign trips, though the end use of the capital really depends on the borrower. As long as it is for a legitimate financial purpose.

The Rate of interest Bank of Baroda?

| Interest Rate | 10.50% p.a. – 12.50% p.a. |

| Processing Fees | Rs.1,000 to Rs.10,000 |

| Loan Tenure | 5 years for government employee 4 years for others |

| Interest Rates and Charges | 10.50% p.a. – 12.50% p.a. |

For existing customers with an account relationship of at least 6 months: 10.50% p.a. For applicants who have an account with any other bank for at least 6 months: 12.50% p.a.

Bank of Baroda Instant personal loan eligibility

- Segment.

- Salaried employees of MNCs.

- Public Limited Company or Large Private Limited Company employees.

- Employees of the State Government or Central Government.

- Employees at Public Sector Undertakings (PSUs) and Joint Sector Undertakings.

- Salaried individuals at educational institutions and autonomous bodies

- Employees of partnership or proprietorship firm.

- Professionals who are self-employ like doctors, practising company secretaries. Engineers, interior designers, management consultants, architects, or management consultants.

- Insurance agents.

- Age

- Applicant should be at least 21 years old.

Minimum employment/business tenure required

- Salaried employees should have a job and work with the current employer for at least 1 year.

- Self-employed persons must have had a stable business for a minimum of 1 year.

- Insurance agents must have been in business for at least 2 years.

- Minimum loan amount

- Metro and urban areas: Rs.1 lakh

- Semi-urban and rural areas: Rs.50,000

- Maximum loan amount

- Metro and urban areas: Rs.10 lakh

- Semi-urban and rural areas: Rs.5 lakh

- 6Tenure

- Up to 60 months

How to calculate EMIs for Bank of Baroda Personal Loans

You can compute EMIs for your Bank of Baroda personal loan through any online EMI calculator. BankBazaar.com has a convenient personal loan calculator which can be use simply by dragging a slider. It makes your loan application easier. You can plan your loan expenses and manage your. Overall finances efficiently with the help of this calculator. To make use of it, you will need to input certain details regarding your loan.

These details include loan amount, loan tenure, processing fee, prepayment fee, and interest rate.

You can pay your EMIs promptly to clear your loan on time. During the first few months of your loan tenure, you will be paying a higher interest. Towards the end of your loan tenure. You will be paying a higher principal compared to your interest.

| Loan For Baroda Personal Loan For Pensioners | personal expenses |

| Bank Name | Bank SBI |

| Interest Rates | 9.60% |

| Minimum EMI | per lakh ₹ 1,832 for 72 months |

| Bank Name | HDFC Bank |

| Interest Rates | 10.25% |

| Minimum EMI | per lakh ₹ 2,137 for 60 months. |

Questions To Ask

- In how many days can I get a loan from Bank of Baroda?

Ans. Banks usually convey their decision on the loan within 15 days of the submission of the loan application. However, some banks also offer instant loan offers, which can. Be approve within a few hours to 2-3 days.

2. What are the personal loan interest rates in Bank of Baroda?

A. The personal loan interest rates in Bank of Baroda range from 10.00% to 15.60%. Bank of Baroda personal loan interest rate for salary account holders is. Comparatively low as compared to other customers.

3. What is the minimum personal loan EMI?

A. If you apply for a loan from Bank of Baroda, your minimum personal loan EMI per lakh will be ₹ 2,125 which corresponds to a minimum interest rate of 10.00% and a longest tenure of 60 years.

4. What is the tenure of Bank of Baroda personal loan?

Ans. Bank of Baroda personal loan tenure varies from minimum 12 months to maximum 60 months.

5. How much loan can I get?

Bank of Baroda provides loan to you for any amount you need from a minimum amount of ₹50,000 to a maximum amount of ₹5 lakh

6. Can I add my spouse’s income to increase my personal loan eligibility and get more loan amount from Bank of Baroda?

Yes, you can add your spouse’s income to increase your personal loan eligibility and get more loan amount from Bank of Baroda. In this case, the bank will check your spouse’s CIBIL score and ask for all the income. And bank details of your spouse for the purpose of processing your application.

7. What is the credit score require for personal loan from Bank of Baroda?

You must have a good credit score if you want to apply for a personal loan from Bank of Baroda. A credit score above 750 is consider good for a personal loan.

Related Post:- Full Information Business Loan Interest Rate