Atal Pension Yojana:- Through today’s article, we have told you in detail that what is Atal Pension Yojana, what is its purpose and how to apply for it, its age, age limit, to know complete information about all these, definitely read this article till the end.

Atal Pension Yojana:- The main benefit of Atal Yojana is for small and poor people. The Atal Pension Yojana launched by the Government of India is for the people belonging to the unorganized sector.

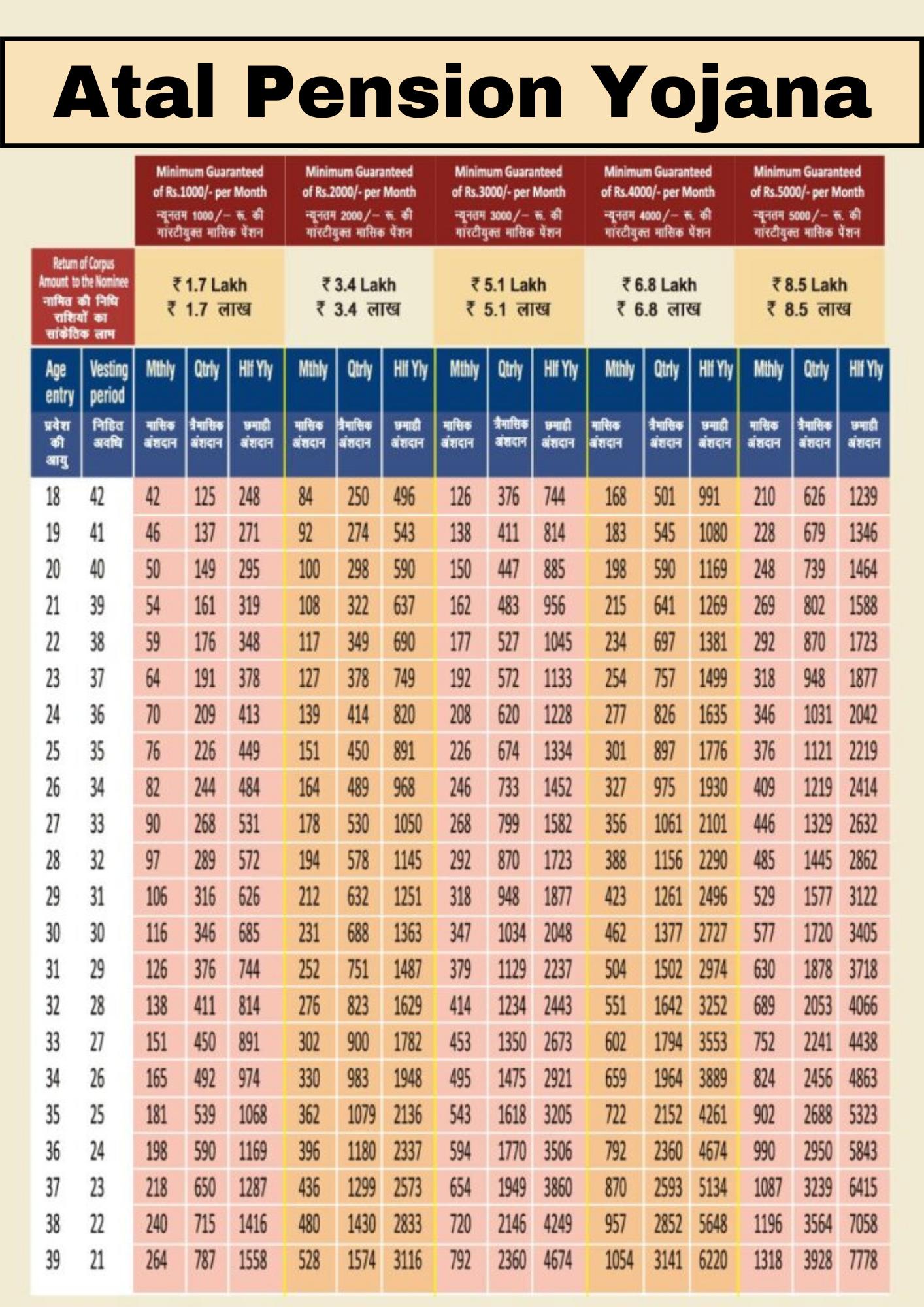

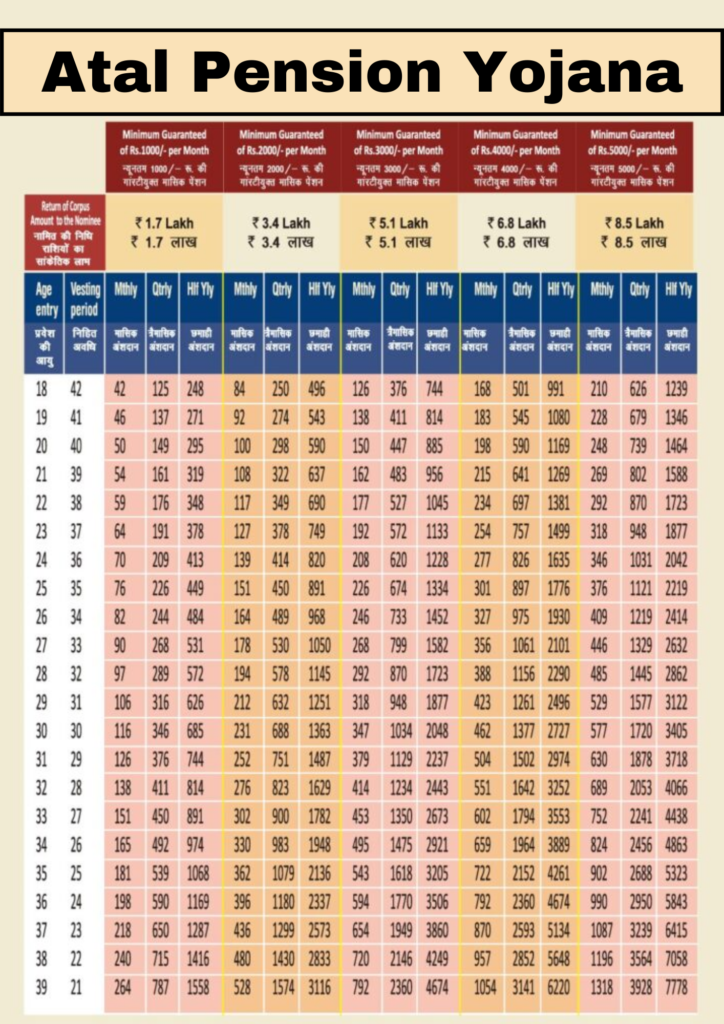

The benefit of this scheme The person connected with Atal Pension will become the beneficiary of this scheme in his old age i.e. after 60 years. If you join this scheme, then you will not need to depend on anyone in your old age. How much pension you will get after your 60 years of age, will be determine according to the amount of your premium and the period of premium paid by you.

If you are now above 18 and below 40 then you can invest in Atal Yojana Is. From when you will attain 60 years of age till your death, you will get 1000 to 5000 rupees per month as pension. How much pension you will get from 1000 to 5000, will depend on how much income you contributed to this scheme before your 60 years.

The objective of Atal Pension Yojana

- This scheme has been name after former Prime Minister Shri Atal Bihari Bajpayee. The main objective of Pension Yojana is that you will not have to depend on anyone else in your old age. In old age, you will be able to bear the cost of your food and drink on your own. For this, you will not need to eat stumbling blocks.

- This scheme was start in 2015 especially for the poor and middle-class people. Under this scheme, you will deposit the instalment in your account at any time in 1 3 months or in 6 months. Which will be give to you in your old age under Atal Pension Yojana.

Eligibility for Atal Pension Yojana

- age 18 to 40 years

- It is mandatory to be an Indian citizen.

- Identity Card:- Aadhar Card, Pan Card and Voter Id.

- It is necessary to have an account in the bank.

Atal Pension Yojana Chart

Apply Online For Atal Yojana

- First of all, open the portal of your private or public bank.

- Enter the Customer ID or User ID and Password as per your branch and then login.

- After this, you will see much online banking.

- Then by clicking on these services, click on Social Security Scheme.

- Afterwards, choose the option of Pension Yojana.

- Here you will be ask for your bank account number and CIF number. After entering both there, click on submit.

- Next, fill in whatever you will ask about you (enrollment applicant, your address etc.) and click on submit.

Now you have to fill in the details like deduction amount, pension filling date etc. and click on submit again.

In this way, you have applied online for Atal Yojana. In no time SMS will come on your mobile number for registration of Atal Pension Yojana.

Atal Pension Yojana Age

- If your age is above 18 and below 40, then you can invest in Atal Yojana. From when you will attain 60 years of age till your death, you will get 1000 to 5000 rupees per month as pension.

- How much pension you will get from 1000 to 5000, will depend on how much income you contributed to this scheme before your 60 years. The person will become the beneficiary of this scheme in his old age i.e. after 60 years.

Atal Pension Yojana Age Limit

- Only people above 18 years and up to 40 years can invest in Yojana.

- Features / Benefits of Atal Yojana.

- Under this scheme, you will get 1000 to 5000 per month as a pension after 60 years.

- According to their age and year of investment, people involved in this scheme can get a pension of 1 to 5 thousand rupees per month by paying different premiums every month.

- If the beneficiary dies before 60 years of age, then his/her spouse can pay its premium and take benefit of the scheme.

- Related Post:- You Need To Know 2 lakh UP Bhagyalakshmi